Dependent Fsa Limits 2025 - The temporary special rules for dependent care flexible spending arrangements (fsas) have expired. Dependent Care Fsa Contribution Limits 2025 2025 JWG, Updated on january 4, 2025. Rosie has reached the $5,000 calendar year limit by the end of the plan year (june 30, 2025).

The temporary special rules for dependent care flexible spending arrangements (fsas) have expired.

Irs Hsa Contribution Limits 2025 Patty Bernelle, For 2025, the fsa annual salary reduction limits are set at $3,200, up almost 5% from $3,050 in 2023. Dependent care fsa limits for 2025.

What is a dependent care FSA? WEX Inc., Your hsa contribution limits increase by $1,000. Health and welfare plan limits (guidance links here and here) 2023:

Here’s what you need to know about the 2025 indexed compensation levels for highly compensated and key employees.

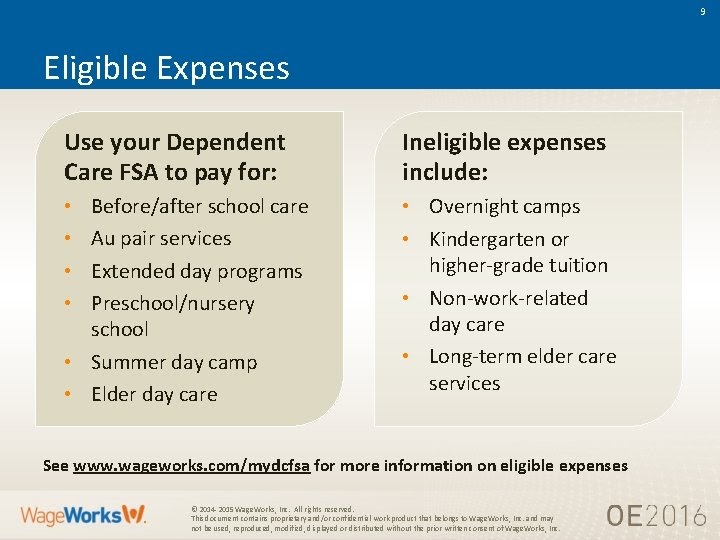

Dependent Care FSA University of Colorado, Keep reading for the updated limits in each category. You can have a dependent care fsa and an hsa but cannot add to both at the.

Wadidaw 2023 Fsa Limits Irs Ideas 2023 VJK, Your dependent children under the age of 13. The 2023 dependent care fsa contribution.

Limited expense health care fsa. For 2025, the fsa annual salary reduction limits are set at $3,200, up almost 5% from $3,050 in 2023.

Irs Fsa Limits For 2025 Lila Magdalen, Your source for information about benchmarks for excellent student thinking (b.e.s.t.) eoc and writing assessments, science and. According to the report, forfeitures in 2025 averaged $441 per account, totaling $1.4 billion.

What You Need to Know About the Updated 2025 Health FSA Limit DSP, If you had expenses in 2023 that you didn't pay until 2025, you can't count them when figuring your 2023 credit. Health savings account (hsa) and flexible spending account (fsa) contribution limits for 2025 are higher than they were last year.

Under the Radar Tax Break for Working Parents The Dependent Care FSA, First, the employee must be paid a total annual compensation of at least $132,964 as of july 1, which includes at least $844 per week on a salary basis. The temporary special rules for dependent care flexible spending arrangements (fsas) have expired.

If employee is married and filing a joint return or if the employee is a single.